Demand is up - but not as we know it

This latest Daft.ie Rental Report - covering the market nationwide to January 2021 - presents the first concrete evidence of an idea that's been floating around since early in the Covid-19 pandemic. That is the theory that, of all rental markets in the country, Dublin would be most badly affected by the collapse in everyday activity.

The figures in this report examine rents in 54 rental markets in Ireland: the 22 postcodes of Dublin, plus North, South and West Dublin, the four other major cities, and then the 25 other counties. Outside Dublin, rents are rising in all 29 - albeit just about in the case of Donegal (+0.4% year-on-year) but extraordinarily strongly in Munster, with rents up 9.9% year-on-year in Kerry. Rents are rising in the four other cities outside Dublin too - from 3.9% in Limerick city to 5.6% in the case of Waterford city.

But across Dublin's 25 markets, rents are falling in 23. The only exceptions are 'just about' exceptions, with modest annual increases in rents of 0.2% in Dublin 24 and 0.5% in Dublin 20. In Dublin 1, Dublin 4 and Dublin 6, rents in the final three months of 2020 were 6% lower than a year previously, while in Dublin 2, they were 7% lower.

The unusually clear signals from the report confirm two important facts. The first is that Dublin and the rest of the country do not constitute the same rental market. However many rental markets there are in Ireland, it is certainly more than one - with conditions so vastly different in Dublin to the rest of the country.

And secondly, it reaffirms a long-standing stylised fact in the capital's rental market, which is that the city is indeed one market and, while there are variations in the trend, ultimately if rents are falling in one part of the city they are falling in them all. We have seen this consistently over the last two decades - in the rise in rents at the turn of the millennium, the fall to 2004, the late Celtic Tiger upswing that ended in 2008, the short but sharp fall in the following two years... and of course throughout the extraordinary prolonged upswing in rents during the 2010s.

There are two ways of interpreting falls in rents. The first is a fall in demand, as would be expected with a big increase in unemployment. The second is an increase in supply - as might happen where significant numbers of short-term lettings move over to the long-term rental market.

There is a way - using the numbers in this report - to distinguish between these two competing explanations. The number of listings coming on to the rental market is a good measure of active rental supply. This is a flow measure (how many homes were listed during, say, the period October-December 2020?), as opposed to a stock measure (if you were to go online on October 1st, how many homes were available to rent at that point in time?).

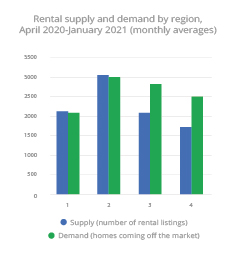

To proxy rental demand, we can use the number of homes that came off the rental market in particular period. This captures active, rather than latent, demand - in that you will add to the total only when you take up a new home to live in, as opposed to simply wanting somewhere to rent. The figure below shows, for the period April 2020-January 2021, those two measures of supply and demand, for Dublin and for the rest of the country. It also shows, for comparison, statistics for the same period a year earlier (April 2019-January 2020).

There are three main takeaways from this chart. The first is that (actual) demand in Dublin has largely kept pace with the city's rental supply: the average number of rental listings per month in the capital rose by 42%, from 2,155 to 3,053, during the period April 2020--January 2021. However, the number of rental listings coming off the market rose by almost exactly the same fraction: by 40%, from 2,146 to 3,010. Despite all the limits on who can do what and where, market 'liquidity' has, if anything, improved in Dublin over the last year.

This leads to the second takeaway - and one critical for policymakers. The ability of demand to 'step up' when new supply comes on board shows just how vital it is for the construction of new rental supply to remain a priority for policymakers. The last two decades have seen highly suppressed household formation in Ireland - that's policy jargon for people having to stay at home with their parents longer or, alternatively, live with friends or strangers in three- and four-bed houses because too few homes for one- and two-person households exist. This may seem like a very particular point but falling household size is adding about 10,000 new homes needed every year in Ireland... for decades!

The final takeaway concerns the rest of the country. Here, the picture is the opposite to Dublin. Rather than a more liquid market bringing rents back down from a spike, it is an even more strained market seeing rents rise even further. Compared to the same period a year earlier, the number of homes coming on to the rental market outside Dublin fell by 17% April 2020-January 2021, from an average of 2,073 per month to just 1,715. Demand also fell, but by less (just 10%) and remaining at a higher level than supply (2,490 properties coming off per month).

I started this commentary by noting how this report conformed to many people's priors, that Dublin's rental market would be the most badly affected by Covid-19. That much is true but the channel appears to be entirely supply, rather than demand. If anything, rental demand outside Dublin has fallen over the last year - while in Dublin it has increased one-for-one with supply.

Let's see what the next few months bring!

Written by Ronan Lyons

Source Daft.ie